Islamic fintech can help the sector expand its reach

Islamic fintech platforms enhance and improve the reach and effectiveness of Islamic banking instruments

The rapid digitalisation of our world has fundamentally changed how the banking industry operates and delivers its services. Today, banks are competing beyond financial services. Seamless and instant digital banking has become an essential business offering.

A similar disruption has been observed in the Islamic finance sector, which has turned to financial technology or fintech to expand its market reach.

Experts at the MEED-Mashreq Islamic Finance Business Leaders Forum strongly advocated the role of fintechs in enhancing the inclusivity and accessibility of Islamic finance instruments.

“Fintech is an integral part of the overall development story,” said panellist Jawaad Chawla, a UAE-based senior corporate and structured finance and banking leader, and an Islamic finance specialist. “Given the pace at which fintech is growing, Islamic finance does have a lot to align with, in terms of increasing awareness as well as speeding up their digital adoption processes. The demographics, the connectivity and the ever-growing financial inclusion are all key drivers of this growth.”

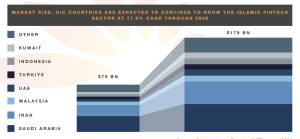

The global Islamic fintech market saw transaction volumes of $79bn in 2021, and is expected to reach $179bn by 2026, according to a report by research firm DinarStandard and ethical advisory and investment firm Elipses.

Saudi Arabia and the UAE rank in the top six markets by transaction volumes, and are seen as leading hubs for digital innovation.

Source: Global Islamic Fintech (GIFT) report 2022

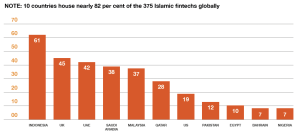

The report further notes that 10 countries house nearly 82 per cent of the 375 Islamic fintechs globally.

Volume of Islamic fintech by countries (top 10):

Source: Global Islamic Fintech (GIFT) report 2022

Islamic finance readily lends itself to various structures within the fintech space, added Chawla.

“Peer-to-peer, crowdfunding, profit-sharing – all of these align with the fundamentals of Islamic finance. This also democratises the potential for funding and financing, which is again aligned with equitable financing and Islamic principles. I see a very bright future for Islamic banking and sukuk in the fintech arena.”

Typically targeting a younger population segment, Islamic fintechs find that high internet and mobile penetration enables them to disrupt typically siloed processes. It adheres to the same principles as Islamic finance – prohibiting profits from debt, interest charges and businesses related to alcohol, tobacco and gambling, besides stocks of conventional banks, insurance companies and other types of financial institutions.

Islamic finance is also well-placed to drive the adoption of ESG and sustainable development goals (SDGs), with their shared principles of equitable investments for the environment and society. Experts rally that fintech can provide an added layer of ease and innovation to this process.

“I see ESG and fintech as the two rocket ships that can help Islamic finance sustain its growth trajectory,” said Michael Grifferty, president of the Gulf Capital Market Association (GCMA), a regional trade association focused on the Arabian Gulf debt and equity markets.

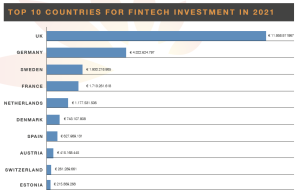

Islamic fintech remains in the early stages of development, lagging behind conventional fintech firms. One challenge limiting growth is the lack of sharia-compliant funding, as most of the available budget is traditional and based in non-Muslim countries such as the UK, Germany and Sweden. Only a small number of investors in the Middle East meet the requirements.

Source: TechEU

Source: TechEU

This is, however, changing. For example, Wa’ed Ventures, the venture capital arm of the Saudi Aramco Entrepreneurship Centre, led the $50m Series B funding round of New York-based Islamic fintech start-up Wahed in June 2022.

Regulations promoting innovation are further necessary to ensure Islamic fintechs can scale up and compete with regional and global financial players. Specific Islamic fintech regulations can help create a more distinct identity from conventional fintech. Enabling a competitive environment will allow for the further proliferation of Islamic finance products.

Looking ahead, Sohail Zubairi, AAOIFI certified sharia advisor and auditor and IICRA accredited Islamic finance arbitration expert, said that “security token will be the next big thing when it comes to digitalisation in Islamic finance”, emphasising the importance of fast emerging security token through which substantial liquidity absorbed by the real estate assets can be released by way of fractionalisation of the ownership and its sale through tokens which could be structured as the asset-based or asset-backed, similar to a sukuk.

Having mentored over 30 Islamic fintech start-ups for DIFC Fintech Hive, Zubairi added: “Islamic security tokens will allow internationalisation of local ownership with round the clock global trading and could be an ideal savings tool for retail household investors for whom not much is currently offered by the markets”.