A new era for EPC contractors

A growing pipeline of GCC clean energy projects is a major opportunity for the region’s engineering, procurement and construction players

This article is the first in a series that captures key highlights from the MEED-Mashreq Contractors Forum on 30 May 2023, which discussed how the engineering and construction sector can enable the delivery of large-scale solar, hydrogen and carbon capture and storage projects in the region.

With an average of $180bn-worth of contracts awarded annually across the Middle East and North Africa (MENA) region, engineering, procurement and construction (EPC) contractors play a pivotal role in the region’s economic development.

From the construction of the world’s tallest buildings to the engineering of its largest refineries, construction firms have helped turn government visions into reality.

Today, as states are transitioning their economies to meet their net-zero targets, contractors are having to adapt their businesses to confront the decarbonisation challenge.

The development of new oil and gas megaprojects will continue to be a necessity. Still, many EPC contractors will need to explore opportunities in projects that typify energy transition, in the fields of renewable energy, hydrogen production and carbon capture.

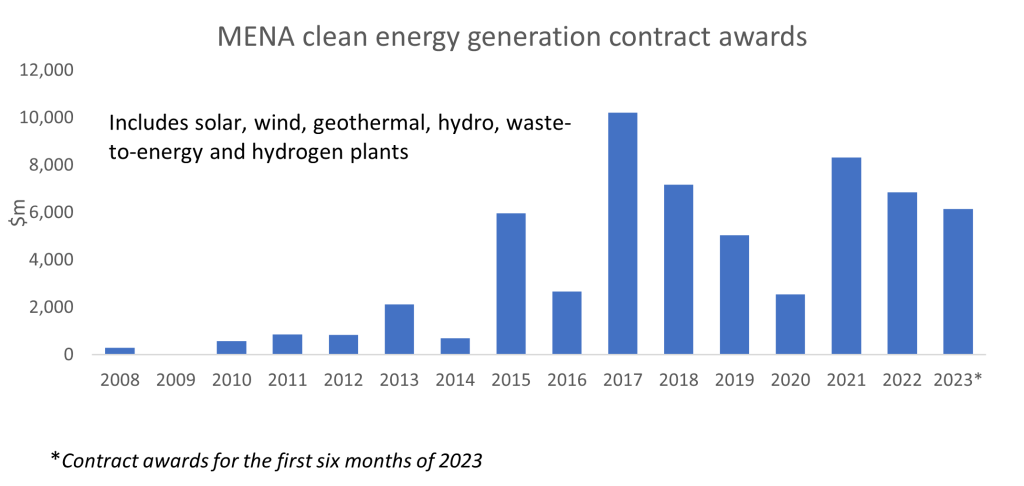

The most established of these three market segments is renewable energy. Investment in utility-scale solar, wind and hydropower production projects has been increasing steadily in the region.

Expenditure reached a record high of $10bn in 2017 thanks to a $3.8bn contract for the hybrid solar photovoltaic (PV) and concentrated solar power fourth phase of Mohammed bin Rashid Solar Park in Dubai and the contract for Abu Dhabi’s first utility-scale solar PV plant in Sweihan.

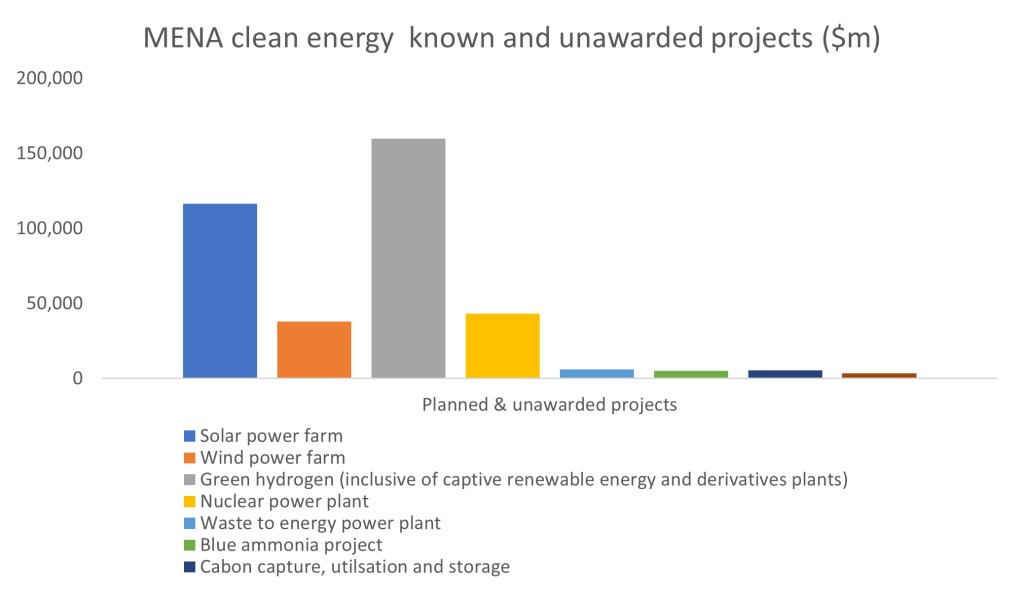

As of mid-2023, over $150bn-worth of solar and wind power plants are in the planning and procurement stages across the Middle East and North Africa (MENA) states, with Algeria, Egypt, Morocco and Saudi Arabia having the largest pipelines.

The UAE and Oman have committed to achieving carbon neutrality by 2050, while Saudi Arabia and Bahrain expect to achieve net-zero carbon emissions by 2060. These targets imply a rapid adoption of policies and increased investments to decarbonise the countries’ power generation sectors.

The region’s high solar irradiation levels and plentiful land availability have made it a prime potential location for green hydrogen production. Several countries in the MENA region – particularly Egypt, Morocco, Oman, Saudi Arabia and the UAE – are developing strategies to become global hydrogen hubs.

An estimated $160bn-worth of green hydrogen projects, inclusive of captive renewable energy power plants, are being planned in these five nations alone. The majority of the projects integrate the production of derivatives such as green ammonia for export to demand centres, particularly in Europe and Asia.

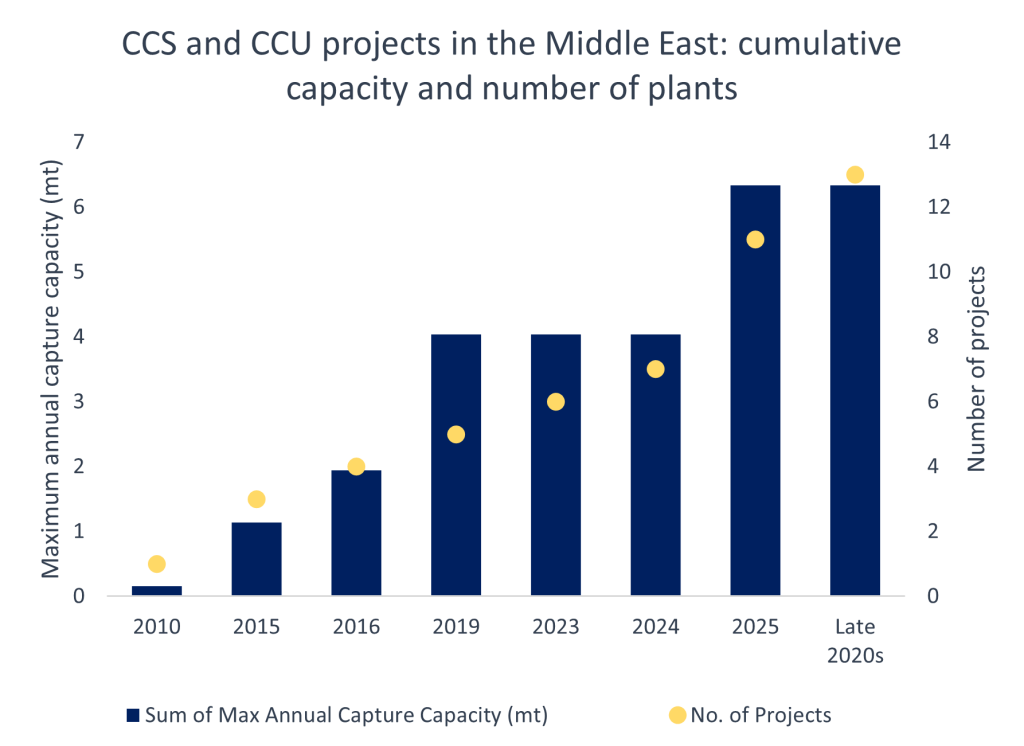

Carbon capture will be integral to the region’s ambitions to become a leader in blue hydrogen production. The GCC already accounts for 10 per cent of the global carbon capture and storage (CCS) and carbon capture and utilisation (CCU) capacity, with almost 4 million tonnes a year of capture and storage capacity.

The region’s hydrocarbon-producing states, such as Saudi Arabia and the UAE, are expanding their blue hydrogen production capacities to cater to demand.

Abu Dhabi National Oil Company (ADNOC) has been cooperating with Japanese and South Korean entities to formulate strategies for commercial production and utilisation of blue hydrogen and blue ammonia. Meanwhile, in April, Saudi Aramco delivered its first blue ammonia cargo to Japan. The kingdom also plans to use the gas produced from its $10bn Jafurah onshore project to process blue hydrogen.

Understanding the challenges presented by the rapidly developing renewable energy, hydrogen production and carbon capture sectors was at the centre of discussions at the MEED-Mashreq Contractors Forum, held in Dubai on 30 May.

“Recent years have seen the GCC states actively reduce their dependency on fossil fuels, both to pursue economic diversification and in response to the global call against climate change,” said Arun Mathur, executive vice president and global head of the contracting division at Mashreq.

“This has paved the way for supportive policy frameworks and the financing of multibillion-dollar schemes geared at clean energy production.”

In 2022, the UAE launched more than $43bn-worth of environmentally friendly energy projects, which form part of at least $160bn earmarked for projects contributing to the country’s 2050 net-zero target, Mathur added.

Heightened risks

The majority of these assets are planned to be developed as public-private partnership (PPP) projects, highlighting the importance of risk-allocation strategies to maintain successful partnerships between project stakeholders.

During the past decade, some GCC states have set world-record-low tariffs for unsubsidised solar power production, primarily due to a significant decline in renewable energy technology and EPC costs, in addition to the scale of these projects.

The prevailing and near-term environment threatens to upend this trend, however. The sourcing of renewable energy components faces persistent supply chain constraints that began during the Covid-19 pandemic and have been exacerbated by the Russia-Ukraine war. Together with the increased cost of finance and a slew of projects coming to the market, this has created a perfect storm for the industry – and particularly for EPC contractors, which need to manage their resources while at the same time complying with more stringent environment, social and corporate governance standards.

Across sectors, and especially in the construction, water and power segments, EPC accounts for the majority of a capital asset’s construction and operation costs. An ultra-competitive environment, where the developer or contractor offering the lowest cost usually wins a contract and where risks are sometimes misallocated between stakeholders, can have dire consequences. It increases the risk of project delays and expensive arbitration procedures, which have driven some contractors out of business or the region.

Things are starting to change for the better, however. “In the renewable energy sector – specifically solar PV projects – the conversation has broadened from a focus on the lowest tariffs to also include the pursuit of certainty of project delivery and ensuring we continue to receive quality proposals by bidders and their EPC contractors,” said Andy Biffen, asset development executive director at Abu Dhabi-based Emirates Water & Electricity Company (EWEC), during the forum.

If adopted across jurisdictions and sectors, this approach shift could help to ensure smoother project execution and delivery as MENA states endeavour to meet their near- to long-term decarbonisation targets.