Opec strategy pays off

10 January, 2018 | By RICHARD THOMPSON

A series of events in the final weeks of 2017 provide a strong indication of what we can expect in the year ahead.

From an economic perspective, the most significant was the 30 November agreement between Opec and non-Opec oil producers to extend the oil production cap to the end of 2018. The move aims to rebalance global oil supply and demand, and remove damaging volatility in the energy markets.

The strategy is working. Oil prices are climbing and the improved outlook gives a degree of fiscal flexibility that will help governments to push ahead with difficult economic reforms.

An initial public offering (IPO) of shares in the fuel distribution arm of Abu Dhabi National Oil Company in December was the first of several listings planned in the region. This will be followed in 2018 by the Saudi Aramco IPO, which could be the biggest share sale in history. These sales pave the way for the more challenging privatisation of the region’s utilities and other state entities.

There is huge investor appetite to buy into the region’s prime assets, and as well as delivering substantial windfalls to governments, the privatisations will have a transformational effect on the region.

Set against this is rising political risk. The ongoing Qatar crisis, the anti-corruption arrests in Saudi Arabia and the missiles fired at the GCC from Yemen, all in December, could undermine investor confidence.

The coming year will continue to deliver shocks. But companies must not lose sight of the powerful, long-term fundamentals driving the region – a fast-growing, young population, an expanding middle class, ambitious and well-funded diversification programmes, and the world’s most abundant energy supplies.

Related Posts

Mashreq posts a 5% y–o–y growth in Net Profit in the first nine months of 2018

Mashreq, one of the leading financial institutions in the UAE, today has reported its financial ...

READ MORE

The decarbonisation agenda is reshaping the planning and delivery of projects in the UAE

The need to decarbonise sits firmly at the top of the policy agenda in the UAE, which ...

READ MORE

Abu Dhabi has re-engaged with stakeholders for the design and route alignment for the upcoming phases of Etihad Rail, the UAE’s federal railway network.

This includes the rail project’s second stage, ...

READ MORE

Governments across the Mena region are recognising the need to strategise their renewable energy investments

With nearly $76bn worth of renewable energy projects planned or underway, according to regional projects ...

READ MORE

Much has been made in recent weeks of measures taken by the authorities in the UAE to boost economic growth.

A series of announcements have been made that promise to change ...

READ MORE

Adnoc intends to transform itself into a global downstream major by investing $45bn to create an integrated refining and petrochemical complex in Ruwais

An astounding investment of $45bn has been announced by ...

READ MORE

After four difficult years, the outlook remains bleak for anyone hoping for a strong pick up in new project opportunities in the Middle East and North Africa

With some $4.7tn of ...

READ MORE

The emirates are working together on major new projects in 2018

The UAE is marking 2018 as the Year of Zayed to commemorate the birth of the federation’s founding president, Sheikh ...

READ MORE

First steps with PPP projects, management bodies, and Saudisation have been taken this year

Saudi Arabia’s Vision 2030 is a mesmerising document that aims to transform the country by overhauling the ...

READ MORE

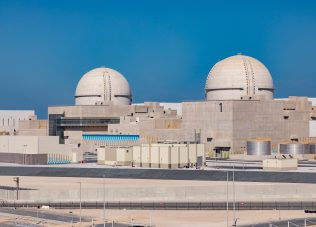

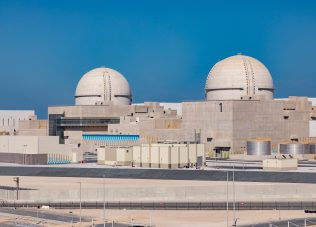

Abu Dhabi government holding company has been rapidly expanding its portfolio

Abu Dhabi Executive Council has issued a decree transferring the full ownership of Emirates Nuclear Energy Corporation (Enec) from the Abu Dhabi ...

READ MORE

Mashreq posts a 5% year–on–year growth in Net

Net Zero in UAE Construction

EXCLUSIVE: Abu Dhabi moves on stalled rail project

BRIEFING PAPER: Sustainable Vision

Claims, not payments, are the big problem in

Abu Dhabi’s ambition to create the downstream Silicon

Four-year Mena projects market dip continues

UAE construction consolidates with Year of Zayed

Saudi construction moves towards Vision 2030

ADQ takes control of Emirates Nuclear Energy Company

10 January, 2018 | .By RICHARD THOMPSON